KEY POINTS

-

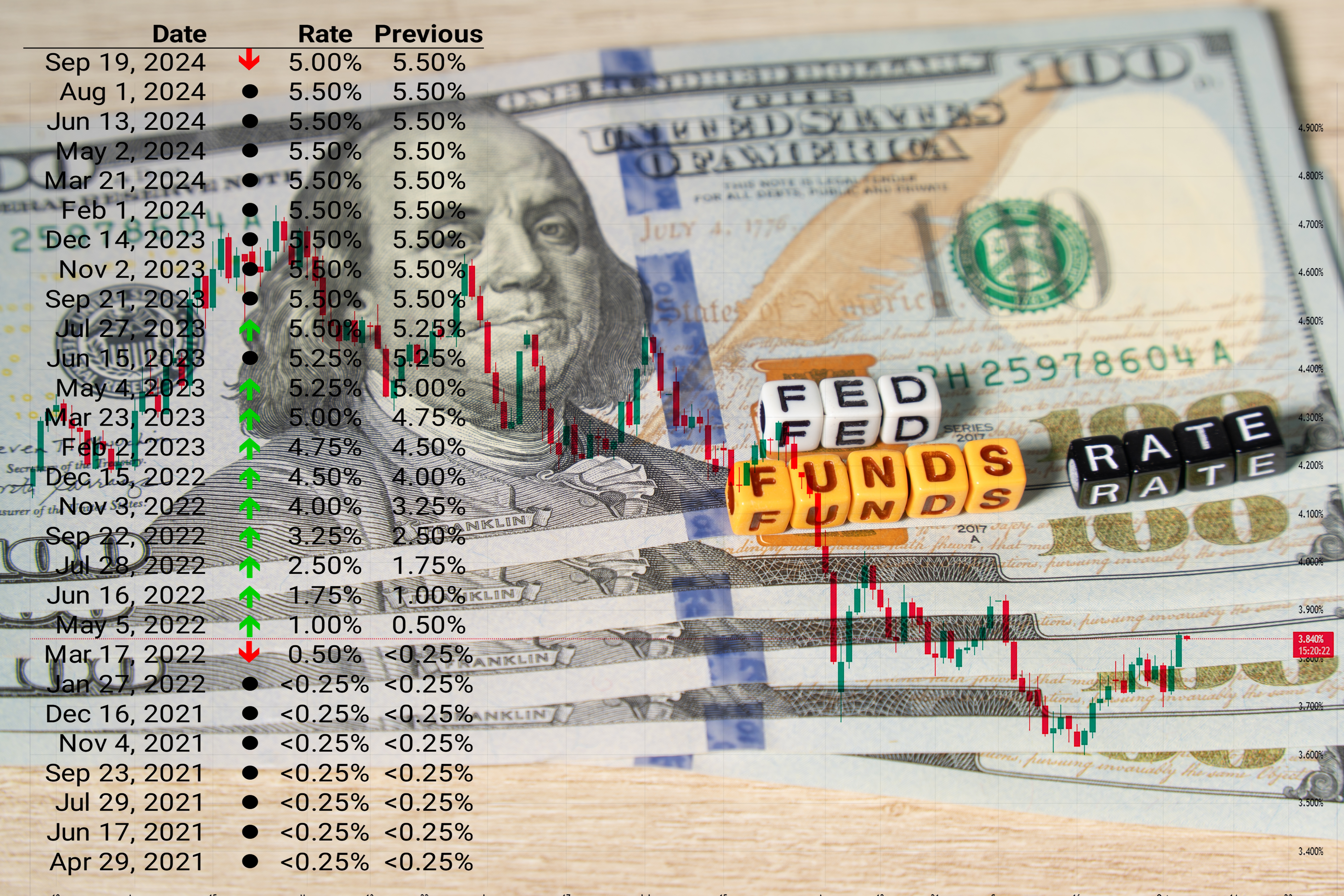

The Federal Reserve cut its key interest rate to a range between 3.5% and 3.75%, marking the third consecutive reduction, but signaled a potential pause in further rate cuts.

-

Economic activity remains moderate, characterized by slower job growth, rising unemployment, and elevated inflation, the Fed stated.

-

The decision faced three FOMC dissents, highlighting divisions within the committee, as officials project only one additional rate cut in 2026 amidst economic uncertainty.

In a move that underscores its cautious approach to navigating economic uncertainty, the Federal Reserve reduced its key interest rate for the third consecutive time today.

The quarter-point cut brings the federal funds rate to a range of 3.5% to 3.75%, marking its lowest level in nearly three years. However, the Fed signaled that it may hold rates steady in the coming months, suggesting a potential pause in its rate-cutting cycle.

The decision, announced after a two-day meeting of the Federal Open Market Committee (FOMC), reflects the central bank’s ongoing efforts to strike a balance between its dual mandate of fostering maximum employment and maintaining inflation at 2%.

In its accompanying statement, the Fed highlighted that economic activity has been expanding at a moderate pace, but noted that job gains have slowed, unemployment has edged up, and inflation remains somewhat elevated.

A Divided Committee

The decision to cut rates was not unanimous, with three members dissenting. The split suggests divisions within the committee as it grapples with mixed economic signals and heightened uncertainty about the economic outlook.

The Fed’s latest quarterly economic projections indicate that officials expect to lower rates just once in 2026, signaling a more measured approach moving forward.

Implications for Borrowers

The rate cut is expected to gradually lower borrowing costs for consumers and businesses, potentially easing rates on mortgages, auto loans, and credit cards. However, market forces and broader economic conditions also play a role in determining the extent of relief for borrowers.

Economic Context and Risks

The Fed’s statement acknowledged that uncertainty about the economic outlook remains elevated. While inflation has risen since earlier in the year, it remains above the Fed’s 2% target. At the same time, the labor market has shown signs of cooling, with slower job growth and a slight uptick in unemployment through September.

The Fed’s cautious tone suggests that it is treading carefully amid a complex economic landscape, balancing the need to support growth while keeping inflation in check.

What’s Next

The next scheduled FOMC meeting is January 27-28, 2026.

About ConstructConnect

At ConstructConnect, our software solutions provide the information construction professionals need to start every project on a solid foundation. For more than 100 years, our insights and market intelligence have empowered commercial firms, manufacturers, trade contractors, and architects to make data-driven decisions and maximize productivity.

ConstructConnect is a business unit of Roper Technologies (Nasdaq: ROP), part of the Nasdaq 100, S&P 500, and Fortune 1000.

For more information, visit constructconnect.com

.jpg?upsize=true&upscale=true&width=255&height=165&name=shutterstock_2551185205%20(1).jpg)

.jpg?upsize=true&upscale=true&width=100&height=100&name=shutterstock_2551185205%20(1).jpg)

.jpg)