KEY POINTS

-

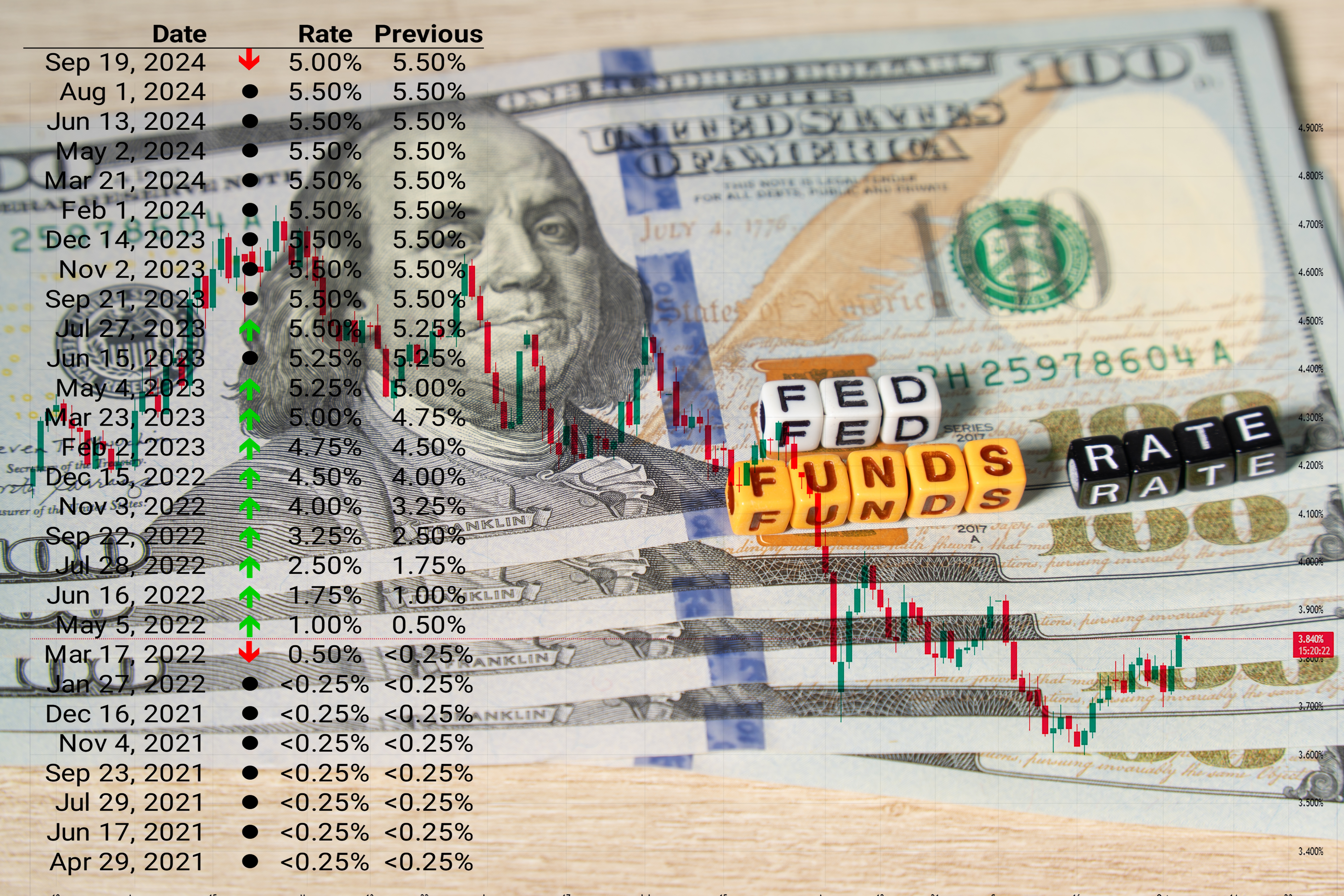

The Federal Open Market Committee (FOMC) lowered the target range for the federal funds rate by a quarter percentage point to between 3.75 percent and 4 percent.

-

Inflation remains a concern, with core CPI elevated at 3% year-over-year.

-

Despite a slight rise in unemployment, construction unemployment remains historically low at 3.9%.

The Federal Open Market Committee (FOMC) lowered the target range for the federal funds rate by a quarter percentage point to between 3.75 percent and 4 percent. The committee cited the move as based on its goals of maximum employment and price stability, noting a shift in the balance of risks.

In a press release following its two-day scheduled meeting, the Fed noted that the economy has been growing steadily, but job growth has slowed down this year. Based on the available economic data, “Uncertainty about the economic outlook remains elevated.”

The decision comes without most government economic data. The government shutdown, which began on October 1, 2025, has postponed the publication of over a dozen major economic reports, including construction spending, jobs data, new home sales, and industrial production.

On Employment

Following the September FOMC meeting, the Fed highlighted the labor market, stating that it “judges that downside risks to employment have risen.”

In today’s announcement, the Fed noted that the unemployment rate has slightly increased, though it’s still low through August.

ConstructConnect Chief Economist Michael Guckes said, “Construction unemployment remains historically low at 3.9%.”

“At that level, construction unemployment is the lowest since June 2023, when COVID spending created a boom in work.”

On Inflation

“Inflation has moved up since earlier in the year and remains somewhat elevated,” according to the Fed’s statement today.

The Consumer Price Index (CPI), released after its expected date due to the shutdown, rose less than expected in September. Still, the core measure, a better indicator of underlying inflation, increased 3% year-over-year, exceeding the Fed’s target by 1%.

Guckes said construction material prices have risen to over 5 percent from 1 percent at the beginning of the year.

Implications for Construction

The rate cut may provide modest relief in borrowing costs for equipment, project financing, and mortgages for contractors, developers, and building product manufacturers.

Mortgage interest rates fell for the fourth consecutive week, prompting increased activity from homeowners and potential buyers.

According to the Mortgage Bankers Association’s seasonally adjusted index, total mortgage applications rose 7.1% from the previous week. If mortgage rates continue to drop, residential construction employment may improve.

%20Change%20in%20000%E2%80%99s%20%E2%80%94%20Total%20%26%20by%20Categories%20%E2%80%94%20September%202025..png?width=730&height=262&name=Change%20in%20Level%20of%20U.S.%20Construction%20Employment.%20Month%20to%20Month%20(M-M)%20Change%20in%20000%E2%80%99s%20%E2%80%94%20Total%20%26%20by%20Categories%20%E2%80%94%20September%202025..png)

Change in Level of U.S. Construction Employment: Sub-Trades Residential and Sub-Trades Nonresidential. Month to Month (M-M) Change in 000’s — Total & by Categories — September 2025. Image: ConstructConnect Construction Economy Snapshot

What’s Next

The next scheduled FOMC meeting is December 9-10, 2025.

About ConstructConnect

At ConstructConnect, our software solutions provide the information construction professionals need to start every project on a solid foundation. For more than 100 years, our insights and market intelligence have empowered commercial firms, manufacturers, trade contractors, and architects to make data-driven decisions and maximize productivity.

ConstructConnect is a business unit of Roper Technologies (Nasdaq: ROP), part of the Nasdaq 100, S&P 500, and Fortune 1000.

For more information, visit constructconnect.com