KEY POINTS

-

Steel prices have jumped following COVID, with recent trade policy changes further elevating costs.

-

Steel producers have expanded capacity at existing facilities following the implementation of tariffs, increasing the amount of domestically produced steel.

-

Construction professionals can make strategic choices to maintain a healthy supply chain and mitigate unexpected price increases.

Steel is a vital material for the construction industry. According to the World Steel Association, building and infrastructure account for over half of global steel usage.

As the largest driver of steel demand worldwide, construction sees steel price changes translate directly into project costs across steel-intensive sectors, including infrastructure, industrial, and commercial projects.

For industry professionals, effective material management has become increasingly important to protecting profit margins from price volatility. Firms with robust supply chain strategies monitor material prices and maintain strong relationships with suppliers. Those firms that do this effectively may avoid profit margin compression coming from sudden material price movements.

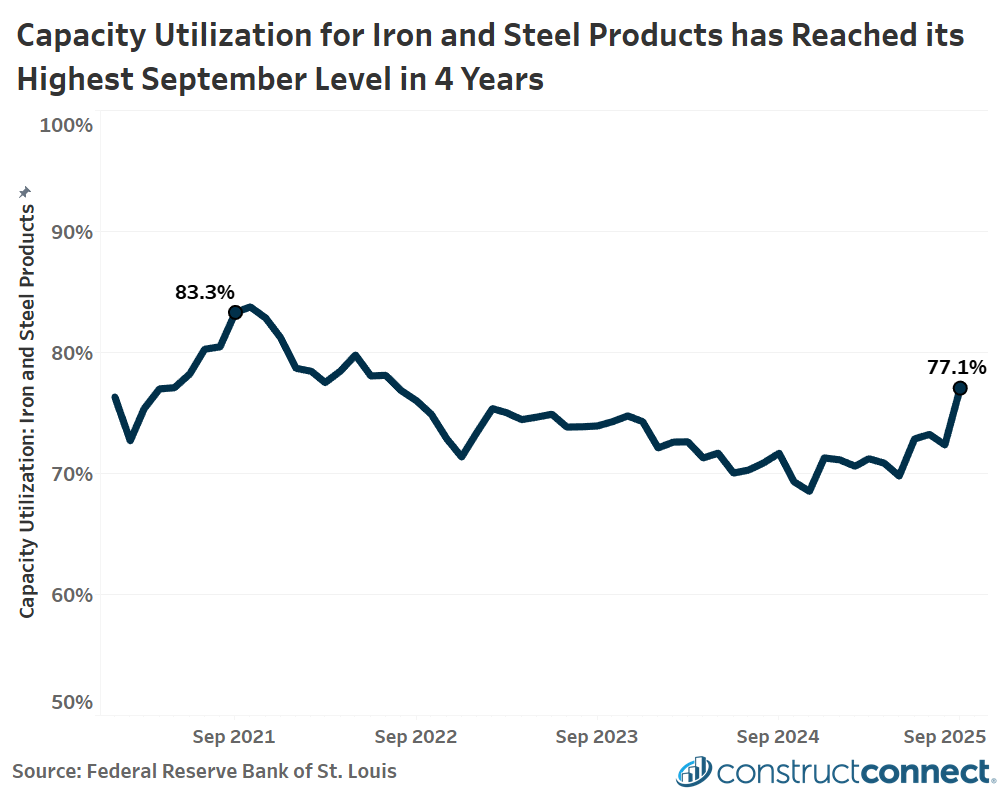

Capacity utilization for iron and steel products increased approximately six percentage points between April and September 2025, indicating producers are increasing output to meet demand. Image: ConstructConnect

Price Volatility Hits Project Costs

Steel prices surged following the COVID-19 pandemic as demand recovered from global shutdowns. Despite moderating from peak levels, steel prices remain elevated above their pre-COVID levels.

Federal Reserve data show that the Producer Price Index (PPI) for hot-rolled steel bars, plates, and structural shapes has declined by around 20% from its June 2022 peak, yet remains 50% above pandemic-era lows.

This sustained price increase translates to project costs, with the National Highway Construction Cost Index rising 60% from Q1 2020 to Q1 2025. A key contributor to the rapid price escalation has been the increase in steel prices, as the material is a crucial structural input in most infrastructure projects.

Price volatility can create considerable operational challenges for construction firms managing steel-intensive projects. Rapid price increases, such as those following the COVID-19 pandemic, compress profit margins due to higher material costs.

Firms with underdeveloped supply chains face a potential competitive disadvantage in construction markets heavily reliant on steel, where material costs can significantly impact project budgets. To mitigate this, companies can explore diversifying suppliers, investing in supply chain technology for better forecasting, or forming strategic partnerships to secure more stable and cost-effective steel procurement.

The Case for Domestic Expansion

Recent trade policy developments have further amplified cost pressures associated with steel prices and strengthened the rationale for domestic capacity expansion. Liberation Day tariffs implemented in April 2025 triggered an immediate 5.4% month-over-month price increase in May.

For the most recent reading in September, the PPI for hot-rolled steel bars, plates, and structural shapes stood 7.9% above pre-tariff levels.

Increased domestic production offers a pathway to reduce reliance on imports, which are subject to import tariffs. Industrial production of raw steel rose 3.8% from April through September 2025, according to Federal Reserve data.

Capacity utilization for iron and steel products also increased approximately six percentage points during the same period, indicating producers are increasing output to meet demand.

Expanded domestic capacity could reduce the construction industry’s exposure to tariff-related cost volatility. Steel sourced from domestic mills avoids import duties, which have reached 50% this year, providing a competitive advantage over imported alternatives.

Beyond near-term tariff protection, increased domestic capacity provides insulation from future trade policy shifts, domestic or foreign.

The Outlook for Steel and Construction

Elevated steel prices have presented a persistent challenge to cost management for construction firms. Despite moderating from pandemic peaks, steel prices remain significantly elevated, driving substantial increases in project costs across construction categories, including infrastructure, industrial, and commercial.

This means effective supply chain management has become essential to protecting profit margins.

Trade policy introduces additional uncertainty that compounds the effects of previous economic shocks. Recent tariff implementations have triggered swift price hikes that have remained in the months following.

Domestic capacity expansion offers a pathway towards more predictable and stable costs, though progress requires sustained investment over several years. While producers have increased utilization at existing facilities, building the production scale necessary to reduce import reliance requires significant time and capital commitments.

Construction firms must navigate this period with discipline in their supplier relationships and supply chain management to ensure they can protect their budgets from unexpected material price increases.

Stay Connected

Stay connected with ConstructConnect News, your source for construction economy insights, market trends, and project news.

About ConstructConnect

At ConstructConnect, our software solutions provide the information that construction professionals need to start every project on a solid foundation. For more than 100 years, our keen insights and market intelligence have empowered commercial firms, building product manufacturers, trade contractors, and architects to make data-driven decisions, streamline preconstruction workflows, and maximize their productivity. Our newest offerings—including our comprehensive, AI-assisted software—help our clients find, bid on, and win more projects.

ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.

For more information, visit constructconnect.com