KEY POINTS

-

CUSMA-compliant materials may be exempt from some tariffs, protecting them from trade-related price increases.

-

Understanding the nuances of CUSMA may help you reduce tariff burden on imports amid trade uncertainty.

-

Compliance increases the predictability of material costs and possible competitive positioning advantages for construction firms.

According to the United States Trade Representative, the Canada-United States-Mexico Agreement (CUSMA) governed approximately $1.8 trillion in annual US goods and services traded between the three nations in 2022.

The free-trade agreement has become a critical cost management mechanism for construction materials through tariff exemptions for compliant imports. Understanding the nuances of CUSMA may help you reduce tariff burden on imports amid trade uncertainty.

Why CUSMA Now?

Recent trade developments have elevated CUSMA’s importance for construction material sourcing. Canada has received a 35% tariff rate, while a 25% tariff rate was imposed on Mexico, with exemptions for CUSMA-compliant materials.

Analysis from the Bank of Canada and Fitch Solutions found that 90 percent or more of imports from Canada and Mexico qualify for tariff exemptions under CUSMA. CUSMA applies to most imported materials, potentially allowing firms to avoid substantial price increases from tariffs.

Understanding the Basics of CUSMA Exemptions

To reap the tariff exemption benefits of CUSMA, understanding the basics of compliance with the agreement is the place to start.

CUSMA operates with rules of origin criteria to determine what products qualify for exemptions. Materials wholly obtained in a CUSMA nation qualify for exemptions, while manufactured goods with imported inputs must meet a set of product-specific rules of origin (PSRO) to qualify.

CUSMA product-specific rules of origin typically include the following criteria:

-

Imported input goods must have a different HTS classification code than the final good.

-

A percentage of value must be added to the goods in North America.

-

Imported goods must undergo a specific processing operation within North America.

Understanding CUSMA guidelines can help you identify compliant imports, avoiding potentially substantially increased material costs or compromised bid competitiveness from current trade barriers.

CUSMA for Key Construction Materials

The US nonresidential construction industry depends on key inputs imported from CUSMA nations, Canada and Mexico, to fill in gaps in domestic production. When the US does not produce enough of these materials domestically, we rely on imports from Canada and Mexico to fill the void. Among the most essential imported inputs are steel, concrete, gypsum, and lumber products.

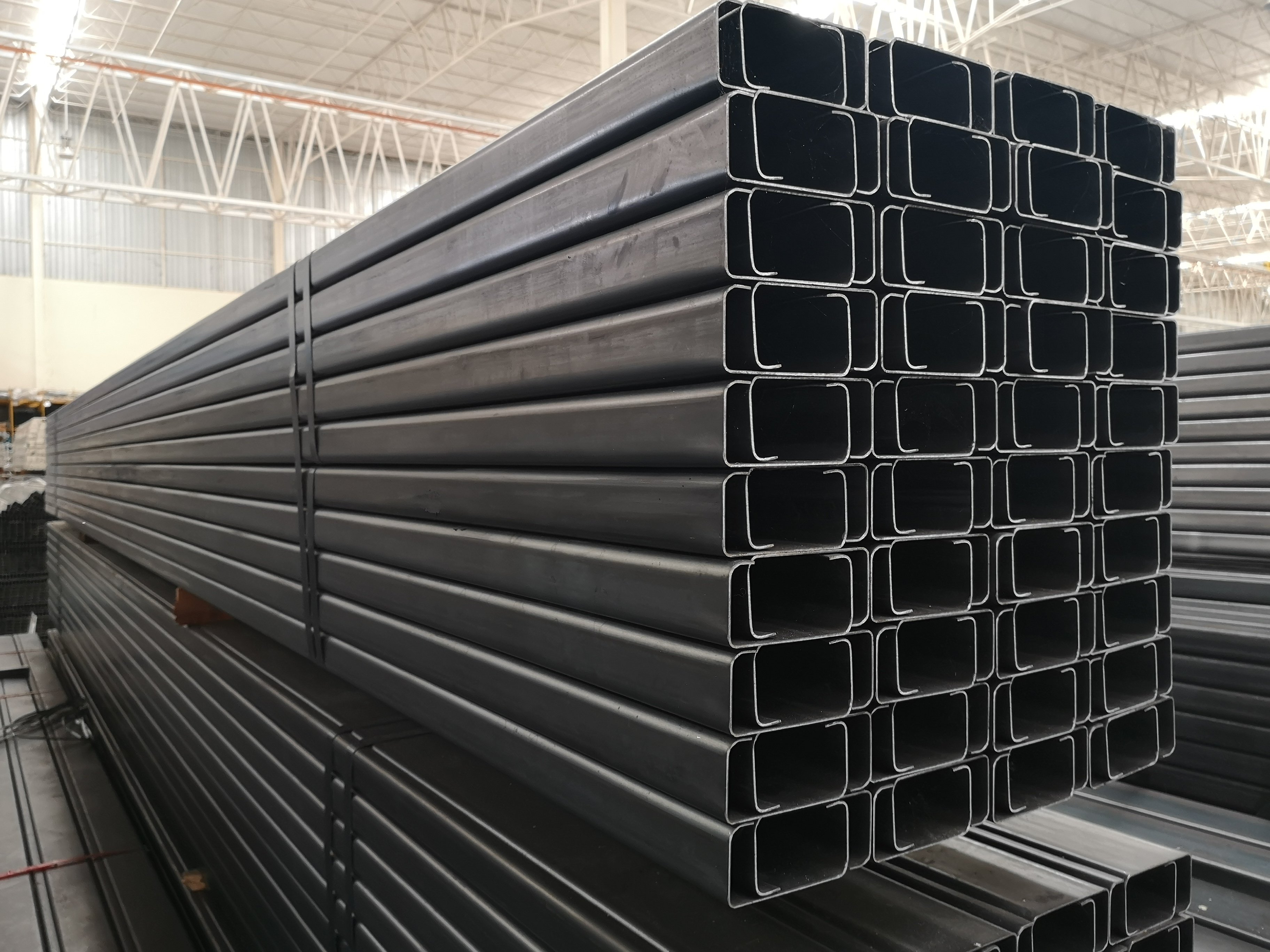

Steel

According to a ConstructConnect analysis of US mineral imports, Canada and Mexico are the two largest steel exporters to the United States. Together, they make up close to 40% of US steel imports. Steel applications in commercial buildings, industrial facilities, and infrastructure projects create substantial exposure to tariff-driven cost hikes.

Cement

In 2024, net imports accounted for 22% of total US cement consumption, with Canada serving as the second largest source, making up 22% of imports. The ubiquitous nature of cement in construction projects means tariff changes affect costs across almost all nonresidential construction sectors.

Gypsum

Gypsum import dependency reached 17% of total consumption, with Mexico and Canada combining to supply 60% of the import market in 2024. Gypsum’s role in drywall, plaster, and flooring applications makes it critical for interior construction throughout nonresidential construction.

Lumber

According to the US Department of Commerce, the US imports around 28% of total softwood lumber consumption, with 84% of imports coming from Canada. Import concentration creates exposure to heavy price hikes with changing trade relationships; however, CUSMA exemptions can provide a shield from tariffs for compliant imports.

These material dependencies show import exposure across several essential construction inputs, creating vulnerability to tariff-related cost increases in nonresidential construction projects.

CUSMA Compliance Advantages for Construction

CUSMA exemptions provide cost protection for nonresidential construction projects using North American material sources. CUSMA covers many construction materials, allowing firms to control costs during changing trade policies.

The cumulative impact of compliance across multiple material categories amplifies potential benefits and cost savings for construction firms. Projects using steel, concrete, gypsum, lumber, and other imported inputs create exposure points where non-compliance with CUSMA, that is, higher material costs, can significantly impact project margins.

Understanding and tactfully applying CUSMA compliance can help construction firms keep costs predictable, which may translate into better competitive positioning.

Projects with compliant material sourcing may help cushion the impact of tariffs, while non-compliant alternatives may face costs that render bids uncompetitive or compromise project viability.