KEY POINTS

-

Data center construction jumped 48% in early 2025, driven by global AI and digital infrastructure demand.

-

State tax incentives are drawing billions in development, making it vital for contractors to track where policy advantages create data center investment hot spots.

-

Abundant, affordable energy remains central to site selection while creating parallel infrastructure opportunities for construction professionals.

Spending on data center construction starts was 48% higher in the first half of the year compared to the same period last year , according to the August ConstructConnect Data Center Report. Growing investment reflects the surging appetite for AI and digital infrastructure worldwide.

Understanding the key drivers of data center development, like state incentives and access to affordable power, is crucial for contractors to anticipate demand, craft competitive bids, and position themselves for long-term growth in an expanding market.

Tax Incentives

Developers are looking for tax packages to lighten their tax burden on these massive projects. Several states have developed tax incentive packages to attract data center projects. For example, Ohio’s program provides tax exemptions for data center equipment, electricity generation, distribution, management equipment, and construction materials. Several states, including Ohio’s, have successfully drawn in substantial investment.

Data center company Cologix recently announced a $7 billion investment in a data center campus in Licking County, Ohio, which could host eight data centers covering 2 million square feet. This is in addition to other large data companies like Amazon, Google, Meta, and Microsoft having a foothold in the state.

The tax incentive program in Ohio has provided huge tax savings for data center developers. A Business Insider analysis found that tax breaks given to data center developers in Ohio return over $2 million in tax savings for every permanent, full-time job they provide. These savings illustrate the substantial value these incentives provide developers and play a key role in attracting data center investment to the state. Tracking which states offer incentives or exemptions is revealing because larger tax savings typically bring larger investment.

Virginia’s data center tax incentive requires that facilities provide $150 million in new investment and 50 new jobs, or $70 million and 10 jobs if the area is distressed. These jobs must be paid 150% of the average annual wage in the area where the data center is located, ensuring that high-quality jobs are provided to the community. Most data centers in the state hit these thresholds, with the Virginia Joint Legislative Audit and Review Commission reporting that about 90% of the data center industry uses the exemption.

Access to Cheap, Plentiful Power

Data centers require large amounts of energy. The International Energy Agency states that data centers accounted for nearly 1.5% of total global energy consumption in 2024, and usage has expanded at four times the rate of total electricity usage since 2017.

Developers are looking for cheap and reliable power because of how much energy these facilities use.

The power demand of data centers brings construction opportunities outside the data centers alone. When utility companies expand generation capacity for these facilities, there is often a slew of energy infrastructure projects to support the expansion. The states attracting the most data centers have robust power grids, often with demand for supplemental energy projects.

Virginia, particularly Northern Virginia, has become the global data hub with over 70% of the world’s internet traffic going through Data Centers in Northern Virginia, according to the Virginia Economic Development Partnership. A primary reason for this dominance stems from the state’s power capabilities, including commercial energy prices well below the U.S. Energy Information Administration’s national average.

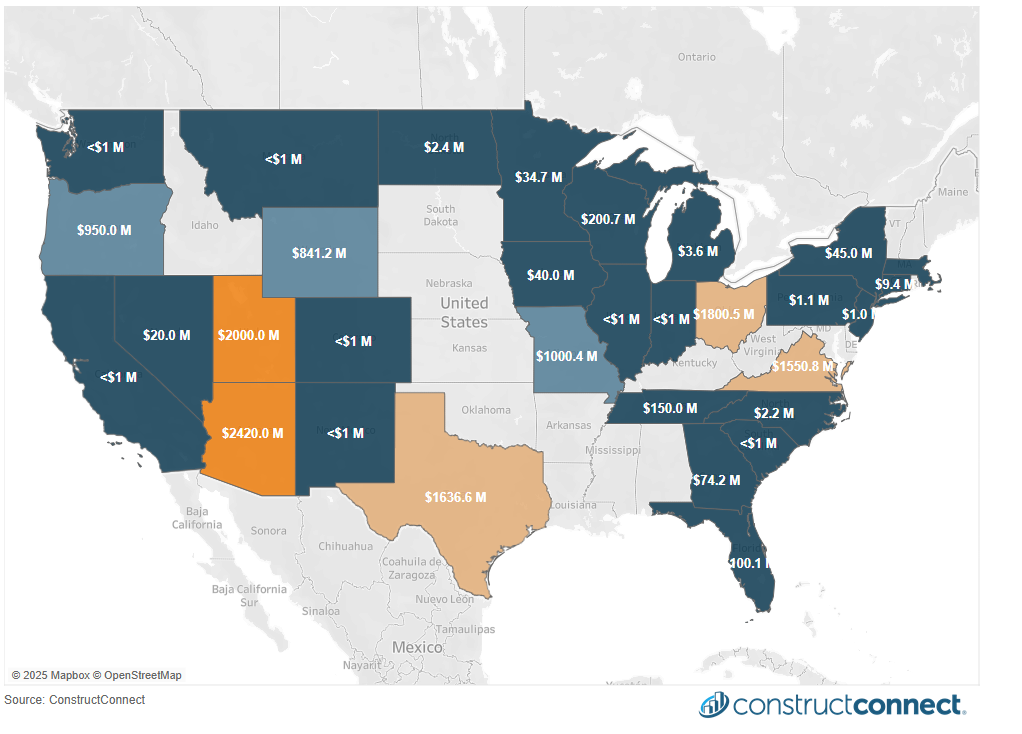

This map shows US Data Center construction starts spending year-to-date through June 2025, in $ million. From the ConstructConnect Data Center Report for August 2025. Image and Data powered by ConstructConnect Project Intelligence

The state’s commitment to expanding its power capabilities has also played an essential role in its development into a data center juggernaut. Dominion, the state’s largest electric utility company, reported 40GW of data center contracts in Q4 2024, nearly double the previous year. The company is also investing heavily in projects like the Coastal Virginia Offshore Wind project, currently the country’s largest offshore wind project. Additionally, Dominion has been involved in increasing regional power transmission capacity, enabling energy transfer from high-supply areas to high-demand areas throughout the region.

Energy prices are a key input in determining where developers build data centers. In fact, 8 of the top 10 states with the most data centers, according to Data Center Map, have commercial energy prices below the national average. Cheap electricity prices lower the operating costs of these facilities, in turn attracting data center investment.

States are becoming increasingly competitive for data center and power infrastructure projects. Contractors and construction professionals who position themselves well can take advantage of the potential job opportunities in these construction projects.