KEY POINTS

-

US data center construction is booming, with June 2025 starts hitting $2.4B and year-to-date totals up 48% to $12.9B, driven by AI and cloud demand.

-

The South and Midwest lead projected 2025 starts, with Ohio, Georgia, and Arizona dominating a market where over 60% of value is concentrated in five key states.

-

Data centers’ rising power needs are fueling parallel energy infrastructure growth, especially in the South and West, highlighting a growing convergence of digital and energy project development.

Mapping the Future of Planned Digital Infrastructure

The race to build the digital backbone of tomorrow is accelerating, and it’s evident in the dynamic world of data center construction. As demand for high-capacity computing, Artificial Intelligence (AI), and cloud storage continues to increase, unprecedented resources are pouring into the planned expansion of data infrastructure across North America.

This exclusive Data Center Report offers a comprehensive look at the latest trends shaping this rapidly evolving nonresidential construction sector.

Leveraging our project data from ConstructConnect Project Intelligence (CCPI), we mapped the current and future state of data center development, distilling insights from projects planned to start before the end of 2025.

This Data Center report highlights:

-

Monthly construction spending trends in data center activity

-

Regional development patterns, including geographic hotspots for major investments

-

Project starts and pipeline analysis through the end of the calendar year

In addition, the report explores the increasing convergence of data center and energy infrastructure projects, shedding light on how the rising tide of digital demand is reshaping the power grid.

Monthly Construction Spending Trends for Data Centers

ConstructConnect reported that total data center starts spending in June 2025 was $2.4 billion, marking a significant increase from last June’s comparable level of $385 million.

Year-to-date (YTD) starts spending through June ended at $12.9 billion, representing a 48 percent increase from the same period a year ago, when total data center starts spending was $8.7 billion.

Monthly data center starts spending has averaged a record $2.76 billion over the past 12 months. The previous all-time high in April of this year was $2.73 billion.

Nineteen data center groundbreakings occurred in June, raising the YTD total and trailing twelve-month (TTM) counts to 104 and 205, respectively.

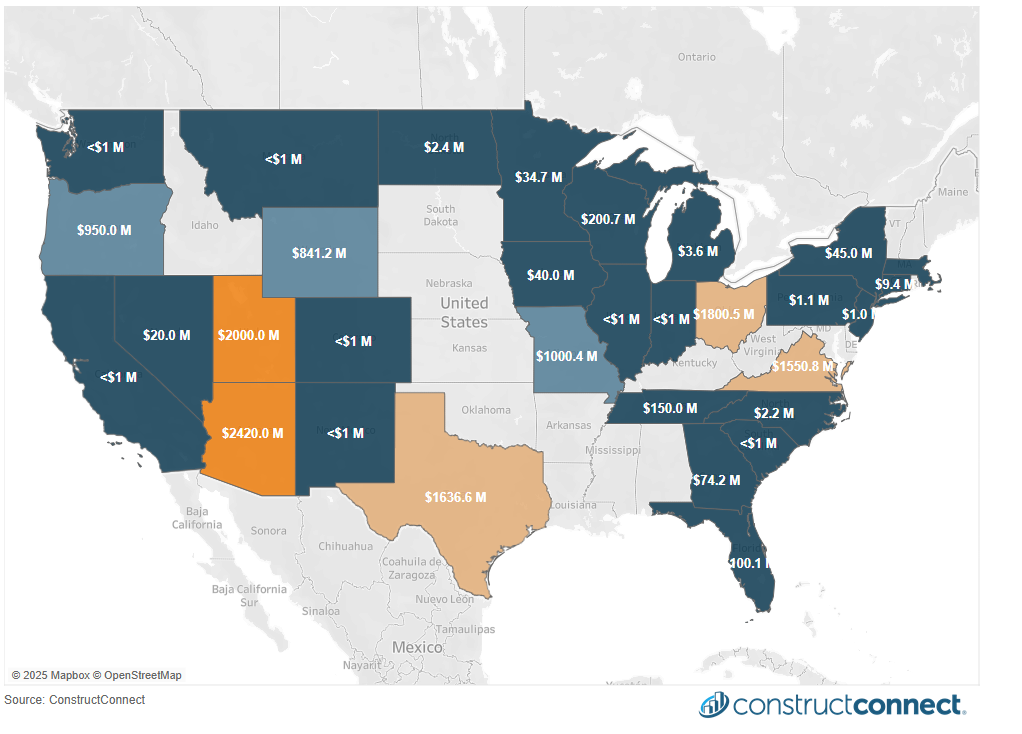

Data Center Starts Spending by US State through June 2025

This map shows US Data Center construction starts spending year-to-date through June 2025, in $ million. Image and Data powered by ConstructConnect Project Intelligence

This map shows US Data Center construction starts spending year-to-date through June 2025, in $ million. Image and Data powered by ConstructConnect Project Intelligence

Regional Patterns of US Data Center Starts

While data centers are being started across the United States, the Western Census region has experienced the greatest spending activity in 2025 and currently totals $6.2 billion YTD. Among the biggest beneficiaries of this regional growth are Arizona ($2.4 billion), followed by Utah ($2.0 billion).

In the South, YTD starts currently stand at $3.5 billion, led by Texas ($1.64 billion) and Virginia ($1.55 billion).

The Midwest region follows closely behind, with a comparable $3.1 billion in starts, carried chiefly by Ohio ($1.8 billion) and Missouri ($1.0 billion).

The Northeast saw limited activity in 2025, with total regional spending of less than $100 million, most of which occurred in New York.

This map displays the regional distribution of total potential data center construction start value across the four US census regions and Canada through the end of 2025. Image and Data powered by ConstructConnect Project Intelligence

This map displays the regional distribution of total potential data center construction start value across the four US census regions and Canada through the end of 2025. Image and Data powered by ConstructConnect Project Intelligence

Data Center Project Starts and Pipeline Analysis Through Year-End 2025

ConstructConnect is currently tracking more than 200 Data Center projects, totaling over $230 billion, with the potential to break ground before the year’s end. According to ConstructConnect Project Intelligence (CCPI), US data center construction starts values for the remainder of 2025 are concentrated mainly in the Midwest and South regions.

Combined, these two regions account for over 60% of the total market value of projected Data Center starts through December.

The South holds the largest share, at 37.1%, while the Midwest boasts 25.1%. The West region comes in slightly behind, with 20.4% of the market, followed by the Northeast at 13.6% and Canada at 3.8%.

State-level data from CCPI shows Ohio and Georgia emerging as the dominant locations for data center starts, with Arizona, Virginia, and Pennsylvania rounding out the top five. Collectively, these states represent over 60% of the North American data center projected starts value through year-end.

While all five top states maintain a strong construction market, California, New York, and Florida are notable omissions from the top five. Further, relatively smaller states and provinces such as New Mexico and Alberta dwarf larger states, showing the decentralized nature of data center construction.

Convergence of Data Center and Energy Projects

Because Data Centers require large amounts of power to operate, they are usually constructed in areas with access to cheap and reliable power. If there is not adequate access to an existing power supply, major energy projects may be required to keep up with demand.

Preconstruction data from ConstructConnect Project Intelligence shows energy projects starting in similar areas to data center construction. The South and West regions account for around two-thirds of the total dollar value of energy project starts through the end of 2025 in the US. As data center construction continues to expand, energy projects are likely to follow.

About ConstructConnect

At ConstructConnect, our software solutions provide the information that construction professionals need to start every project on a solid foundation. For more than 100 years, our keen insights and market intelligence have empowered commercial firms, building product manufacturers, trade contractors, and architects to make data-driven decisions, streamline preconstruction workflows, and maximize their productivity. Our newest offerings—including our comprehensive, AI-assisted software—help our clients find, bid on, and win more projects.

ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.

For more information, visit constructconnect.com