KEY POINTS

-

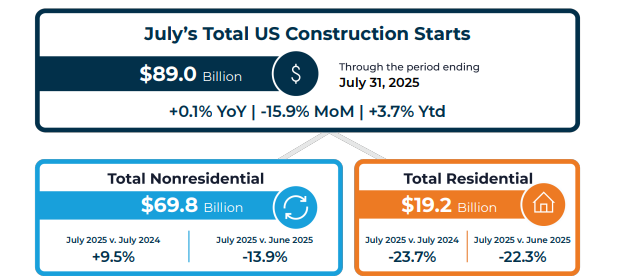

Total US Construction Starts increased by 0.1% year over year, declined by 15.9% compared to the previous month (MoM), and rose by 3.7% year to date (YTD) through the end of July 2025.

-

US Nonresidential Construction Starts dropped to $69.8 billion in July, down 13.9% from June’s record-setting $81.1 billion.

-

Megaproject spending surged 58% YTD, adding $42.5 billion over last year and boosting key sectors like offices, manufacturing, and sports facilities.

ConstructConnect announced today that Total US Construction Starts increased by 0.1% year over year, declined by 15.9% compared to the previous month (MoM), and rose by 3.7% year to date (YTD) through the end of July 2025.

US Nonresidential Construction Starts, the sum of Nonresidential Building and Civil Construction, cooled in July, slipping to $69.8 billion, a 13.9% decline from June’s historic high, according to ConstructConnect Chief Economist Michael Guckes.

Summary chart of Total US Construction Starts through July 2025. Image: ConstructConnect Construction Economy Snapshot

“The July slowdown follows two consecutive months of record-setting activity, with May and June reaching $79.6 billion and $81.1 billion, respectively,” Guckes said.

Michael Guckes, Chief Economist, ConstructConnect

Megaprojects Dominate Market Growth

So far in 2025, U.S. megaproject spending has averaged $16.5 billion per month, lifting total year-to-date investment to a level 58% higher than 2024. The increase adds up to $42.5 billion more in starts compared with last year.

“This increase in megaproject spending has provided a tremendous boost to Nonresidential Building construction, which is overall higher by 14.9 percent year-to-date,” Guckes said.

Key beneficiaries of megaproject spending (projects $1B and up) through June include:

-

Offices (including Data Centers) up 88% YTD

-

Manufacturing Facilities up 66% YTD

-

Sports and Convention Centers up 62% YTD

Summary chart of Total US Nonresidential Construction Starts, the sum of Nonresidential Building and Civil Construction, through July 2025. Image: ConstructConnect Construction Economy Snapshot

Summary chart of Total US Nonresidential Construction Starts, the sum of Nonresidential Building and Civil Construction, through July 2025. Image: ConstructConnect Construction Economy Snapshot

Civil Work Sees Modest YTD Lift

While Civil Construction does not match the pace of Nonresidential Building, Guckes reported that it has gained traction from select large-scale projects.

Spending is up 4.5% YTD in Civil Construction, standouts include:

-

Airport projects up 35.2% YTD

-

Dam/Marine up 26.8% YTD

-

All Other Civil (includes Tunnels) up 20.6% YTD

Residential Construction Lags

The residential sector continues to drag on the broader market. Overall residential spending is down 10.8% YTD, with single-family starts contracting by 12% and multifamily by 8%.

Guckes said that “the difference in performance between single-family and multi-family construction has stabilized since the start of the year.”

He pointed to recent YTD data that indicated a 12% contraction in single-family starts, while only an 8% contraction in multi-family starts.

Stay Connected

Read the Construction Economy Snapshot for more details on construction labor, trends, and regional analysis.

About ConstructConnect

Construction Starts Here™ at ConstructConnect, where our mission is to help the construction industry start every project on a solid foundation. A leading provider of software solutions for the preconstruction industry, ConstructConnect empowers commercial construction firms to streamline their workflows and maximize productivity. ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.

.png?upsize=true&upscale=true&width=255&height=165&name=2026%20Data%20Center%20Starts%20Spending%20Map%20(Cover%20Image).png)

.png?upsize=true&upscale=true&width=100&height=100&name=2026%20Data%20Center%20Starts%20Spending%20Map%20(Cover%20Image).png)