KEY POINTS

-

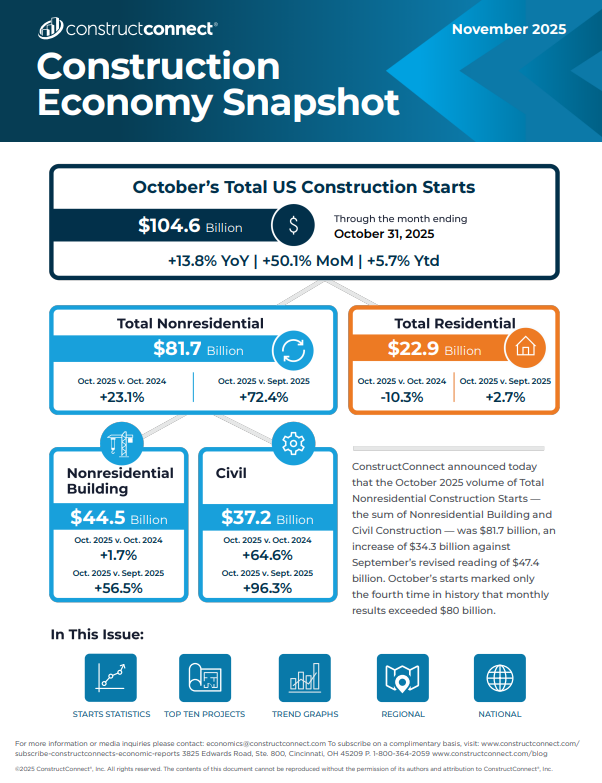

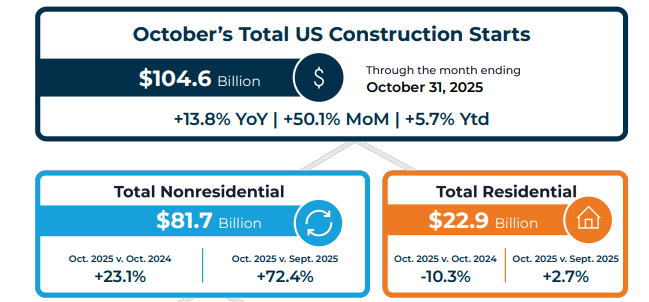

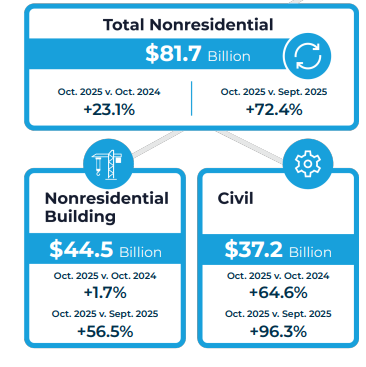

October’s nonresidential construction starts hit $81.7 billion, with megaprojects contributing over $32 billion, marking a significant turnaround from September.

-

Year-to-date civil construction rose 9.1%, with October’s $37.2 billion in starts being the second-highest this year.

-

Residential starts fell, with single-family housing contracting 8.8% year-to-date, despite Federal Funds Rate cuts improving mortgage rates slightly.

ConstructConnect announced today that the October 2025 volume of Total Nonresidential Construction Starts — the sum of Nonresidential Building and Civil Construction — was $81.7 billion, an increase of $34.3 billion against September’s revised reading of $47.4 billion. October’s starts marked only the fourth time in history that monthly results exceeded $80 billion.

October Spending Surge Revives Year-to-Date Spending

ConstructConnect Chief Economist Michael Guckes said that the October results are only the fourth time in history that monthly starts have exceeded the $80 billion mark. At $81.7 billion, it represents a significant and needed turnaround after the lackluster August and September readings, Guckes added.

Of this total, megaprojects—defined as projects with a total value of $1 billion or more—accounted for over $32 billion. October’s megaprojects were concentrated in Offices, Power Infrastructure, and Manufacturing.

Civil Construction Picks Up in October

Year-to-date (YTD) Civil construction through October closed up 9.1%. This was a significant improvement over September’s YTD reading of just 3.4%. October’s monthly Civil starts reading of $37.2 billion was the second-highest this year and the third-highest in the last decade.

Among the month’s top ten highest-value projects, three were Civil projects worth a collective $17.6 billion. Airports, all other Civil, and Power Infrastructure spending have reported double-digit percentage increases YTD.

YTD Nonresidential Building (NRB) maintained its double-digit growth pace through October, thanks especially to manufacturing, which is up 86.8%. Much of this year’s NRB growth has come from the private sector, where industrial and commercial spending is up 54.7% and 41.5%, respectively.

Michael Guckes, Chief Economist, ConstructConnect

In contrast, public sector spending has struggled, with many subcategories down by 10% or more.

Residential starts spending in October was estimated at $22.9 billion, split between $16.5 billion for single-family housing and $6.4 billion for multifamily. Year-to-date, single-family starts have contracted by 8.8%, while multifamily has contracted less at 4.9%.

Recent cuts to the Federal Funds Rate have helped reduce the 30-year mortgage by 50 basis points. However, this has done little to improve housing affordability, which remains near 20-year lows.

Stay Connected

Read the Construction Economy Snapshot for more details on construction labor, trends, and regional analysis.

About ConstructConnect

Construction Starts Here™ at ConstructConnect, where our mission is to help the construction industry start every project on a solid foundation. A leading provider of software solutions for the preconstruction industry, ConstructConnect empowers commercial construction firms to streamline their workflows and maximize productivity. ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.