KEY POINTS

-

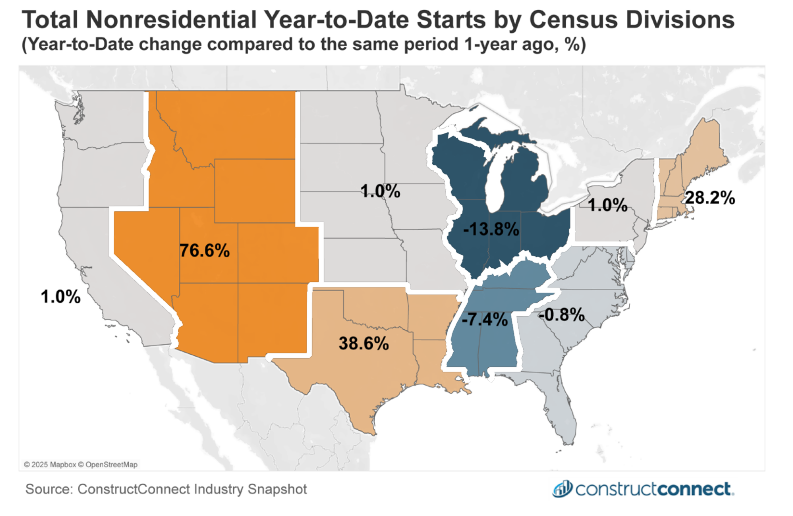

Construction growth varies dramatically across the United States, with the Mountain division showing explosive gains while the West Coast and parts of the Central Plains experience slowdowns or contractions.

-

While nonresidential building faces mixed results, civil construction spending is providing a crucial boost to the industry in most regions.

-

The East Coast generally shows stable or positive growth, with New England standing out as a leader in both nonresidential and civil construction expansion.

Regional US Nonresidential Starts and Spending Trends

A look across the country reveals a mixed picture for nonresidential construction starts through the end of October 2025. Activity along the West Coast continues to slow, with year-to-date growth at a modest 1%. This stands in stark contrast to the Mountain division, which has seen remarkable gains of 77%.

In the middle of the country, the West and East Northern Plains divisions are facing challenges, with growth of just 1.0% and a contraction of 14%, respectively.

Further south, the situation is more optimistic. The West Southern Plains shows accelerating year-to-date growth of 39%. Meanwhile, the East Southern Plains has improved significantly, reporting a 7% contraction, a major improvement from last month's 22% decline.

Along the eastern seaboard, the South Atlantic and Middle Atlantic regions show no substantial change compared to a year ago. New England is the exception, maintaining vibrant activity with 28% growth in construction starts.

Total US Nonresidential Construction Starts by Census Division, year-to-date percentage change compared to the same period one year ago through October 2025. Image: The ConstructConnect Construction Economy Snapshot

Nonresidential Building Activity

The geographic trends in nonresidential building activity closely mirror the patterns seen in overall nonresidential starts. The West Coast is struggling with a 6% contraction in this area. In sharp contrast, the Mountain division leads all other divisions by a wide margin, with an impressive 144% expansion.

The central plains divisions present a mixed view. Three of the four divisions report contracting activity. The only exception is the West South Central division, which includes Texas, where activity has risen by 34%. On the East Coast, all divisions report positive year-to-date gains.

However, New England’s 23% expansion far outpaces the more moderate growth seen in the Middle Atlantic, which increased by 5%, and the South Atlantic, which gained 6%.

The Role of Civil Spending

Civil construction spending has been a significant pillar of support for America’s construction industry this year. Six of the nation’s nine divisions have seen expansion in this sector. Only the Mountain, Middle Atlantic, and South Atlantic divisions show contracting year-to-date civil construction spending.

The West Central Plains and New England regions have benefited the most from civil construction spending on a percentage basis this year. This highlights how infrastructure projects are driving growth in specific areas.

Conversely, the Mountain and South Atlantic regions have experienced double-digit declines in civil construction spending through October, indicating a different set of economic pressures in those areas.

Stay Connected

Read the Construction Economy Snapshot for more details on construction labor, trends, and national analysis.

About ConstructConnect

At ConstructConnect, our software solutions provide the information that construction professionals need to start every project on a solid foundation. For more than 100 years, our keen insights and market intelligence have empowered commercial firms, building product manufacturers, trade contractors, and architects to make data-driven decisions, streamline preconstruction workflows, and maximize their productivity. Our newest offerings—including our comprehensive, AI-assisted software—help our clients find, bid on, and win more projects.

ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.

For more information, visit constructconnect.com