KEY POINTS

-

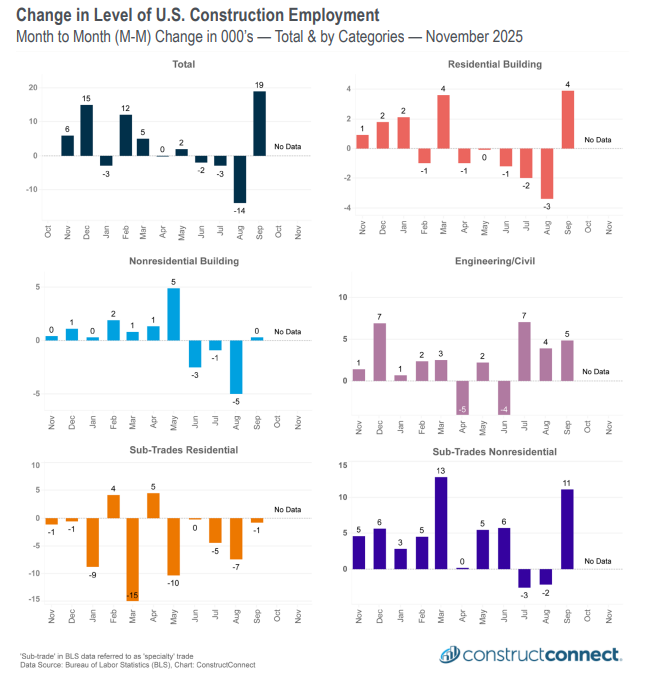

Employment remains weak, with a 105,000-job loss in October and a modest 64,000 gain in November. Unemployment rose to 4.6%, the highest since February 2017 (excluding COVID impacts).

-

Despite seasonal trends, construction unemployment stands at 4.1%, the third-lowest November rate since 2000, compared to a historical average of 7.8%.

-

Residential construction jobs fell by 1,000 over three months, while nonresidential jobs grew by 29,000, highlighting uneven demand within the industry.

Recently, the Bureau of Labor Statistics was able to provide data that had been previously delayed due to the October government shutdown. With the mid-December data release, the Bureau has now brought its reporting up to date.

The latest data, which includes November’s results, suggests diverging labor trends between the broader economy and the construction industry specifically.

Broad measures of employment remain underwhelming. Total jobs fell by 105,000 in October, followed by a better—but still uninspiring—gain of 64,000 jobs in November.

Importantly, the national unemployment rate has risen in recent months, moving from 4.1% at mid-year to a November reading of 4.6%. Excluding the distortions caused by COVID-19, the last time total unemployment was this high was in February 2017, nearly eight years ago.

Change in Level of U.S. Construction Employment. Month to Month (M-M) Change in 000’s — Total & by Categories — November 2025. Image: ConstructConnect Construction Economy Snapshot

In contrast, labor tightness in the construction industry continues unabated, especially given seasonal trends. The latest construction unemployment rate, at a mere 4.1%, marks the third-lowest November reading since 2000.

To put this in perspective, the comparable average November unemployment rate since 2000 is 7.8%. However, labor demand within the industry remains uneven. Over the past three months, total residential jobs have contracted by 1,000 positions, while nonresidential job growth has increased by 29,000.

Stay Connected

Read the Construction Economy Snapshot for more details on construction starts, trends, and regional analysis.

About ConstructConnect

At ConstructConnect, our software solutions provide the information that construction professionals need to start every project on a solid foundation. For more than 100 years, our keen insights and market intelligence have empowered commercial firms, building product manufacturers, trade contractors, and architects to make data-driven decisions, streamline preconstruction workflows, and maximize their productivity. Our newest offerings—including our comprehensive, AI-assisted software—help our clients find, bid on, and win more projects.

ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.

For more information, visit constructconnect.com