ConstructConnect Chief Economist Michael Guckes hosts a monthly video series where he breaks down the key issues impacting the North American construction economy, all in under three minutes.

In this month’s Construction Economy Brief, ConstructConnect’s Chief Economist, Michael Guckes, took stock of the unique performance we have seen in each of the first three quarters of 2025:

- In the first quarter of 2025, performance was very weak. Total Nonresidential construction pulled down total construction by 17% at the year’s start.

- During the second quarter this year, a surge in Civil construction and improvements in other construction types brought total construction to near parity from a year ago.

- In the third quarter of 2025, growth significantly slowed, cutting the YTD rate of total construction in half. Total construction growth through September ended at 3.4%.

Watch the November 2025 Construction Economy Brief

Peeling Back the Layers on 3rd Quarter Construction Economy Performance

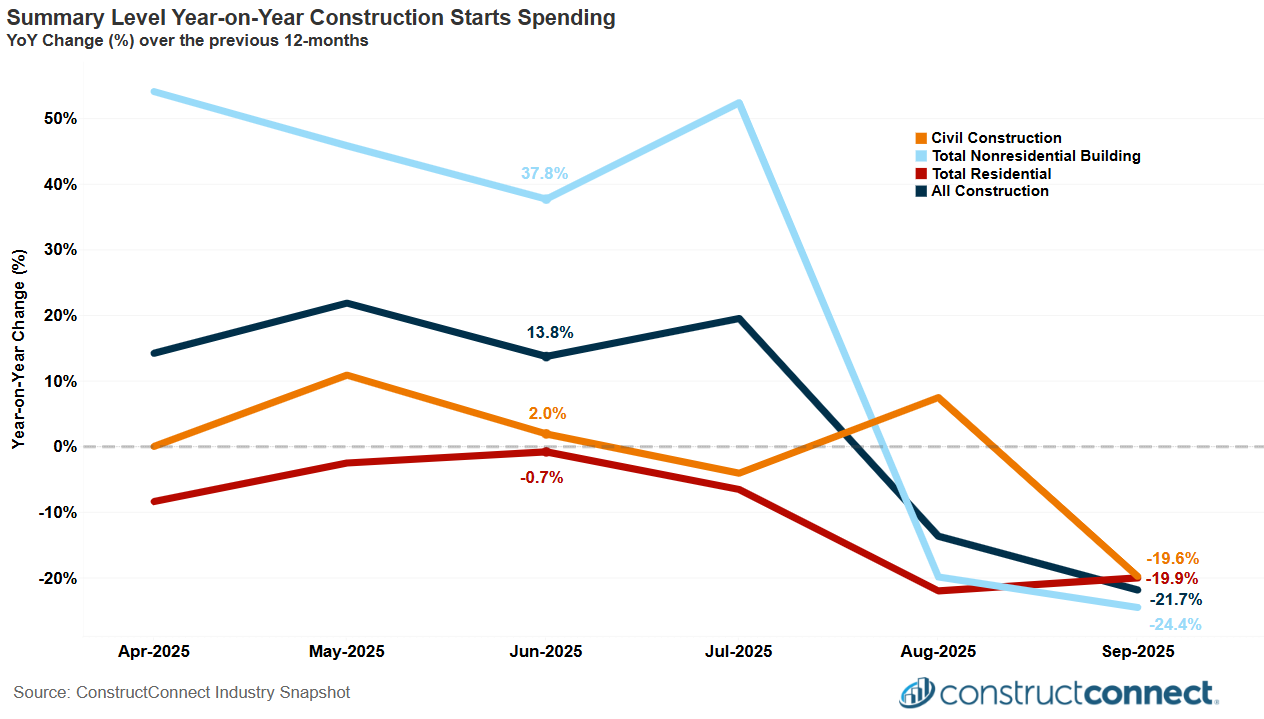

Guckes said, “Monthly results during the third quarter pointed to an abrupt downshift in spending beginning in August and generally worsening in September.”

He added, “Nonresidential construction in particular saw consecutive months on year-on-year (YoY) contractions of 20% or greater in both months. Similarly, residential construction also reported acceleration contractions in YoY results after June saw spending at near break-even levels with the prior June.”

The third-quarter 2025 Construction Starts Spending slowdown is illustrated in a chart from ConstructConnect. It shows the year-over-year comparison of Civil Construction, Nonresidential Building, Total Residential, and All Construction. Image and Data: ConstructConnect Construction Economy Snapshot

For the third quarter of 2025, Guckes noted that monthly results saw YoY spending contract by nearly 22% in August. Conditions in September were little changed, with YoY spending down almost 20%.

Stay Connected

Read the Construction Economy Snapshot for more details on construction labor, trends, and regional analysis.

About ConstructConnect

At ConstructConnect, our software solutions provide the information construction professionals need to start every project on a solid foundation. For more than 100 years, our keen insights and market intelligence have empowered commercial firms, building product manufacturers, trade contractors, and architects to make data-driven decisions, streamline preconstruction workflows, and maximize their productivity. Our newest offerings—including our comprehensive, AI-assisted software—help our clients find, bid on, and win more projects.

ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.

For more information, visit constructconnect.com

.png?upsize=true&upscale=true&width=255&height=165&name=2026%20Data%20Center%20Starts%20Spending%20Map%20(Cover%20Image).png)

.png?upsize=true&upscale=true&width=100&height=100&name=2026%20Data%20Center%20Starts%20Spending%20Map%20(Cover%20Image).png)