KEY POINTS

-

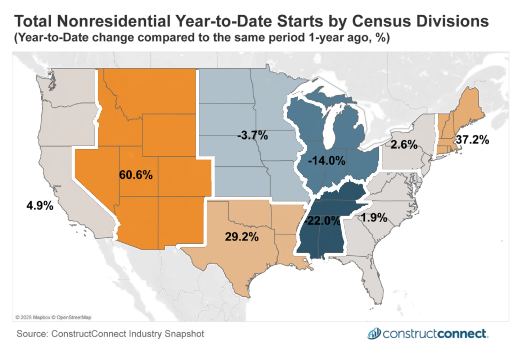

Regional disparities dominate 2025 nonresidential construction trends, with strong growth in select areas, such as the Mountain division, contrasting with declines in the Central and Midwest regions.

-

Civil spending struggles to maintain momentum, with only New England, East North Central, and the West Coast showing gains, while much of the nation falters.

-

Nonresidential Building activity highlights stark contrasts, with double-digit growth in Mountain, West South Central, and New England divisions, but significant declines in East and West Central regions.

A complex picture of growth and decline is emerging across the U.S. nonresidential construction sector in 2025, with significant regional variations in spending. While some areas are experiencing robust expansion, others are facing notable struggles, creating a disparate national landscape.

Mixed Results in Nonresidential Starts

Year-to-date nonresidential starts spending growth remains tepid along the West Coast, with a modest expansion of 4.9%. This growth may be just slightly more than the latest measures of construction inflation.

In sharp contrast, activity in the Mountain division remains impressive at 61%, although this is down slightly from the 80% reading from August. The division’s exemplary growth this year has been largely thanks to TSMC’s multi-billion-dollar investment in chip foundries earlier this year.

The Central and Midwest divisions, however, continue to struggle. Only the West South-Central region, which encompasses Texas, remains vibrant, with starts spending up 29% from the same period a year ago.

Along the eastern seaboard, the South Atlantic and Middle Atlantic regions have slowed to sub-3% growth. Only in the New England division does activity continue to be vibrant, with starts growth of 37%.

Total nonresidential construction year-to-date starts by US Census division through September 2025. Image: ConstructConnect Construction Economy Snapshot

Nonresidential Building Activity

Nonresidential Building, or NRB, activity remains extremely disparate this year. Strong double-digit gains are evident in the Mountain division, up 144%, the West South Central region, rising 43%, and the New England region, up 33%.

In contrast, several regions remain significantly down from the same period a year ago, including the East South Central, which is down 35%, the East North Central, which fell 30%, and the West North Central, which dropped 12%.

The South Atlantic rose 12% and the Middle Atlantic added 6%, and both continue to report incremental gains above the rate of inflation. Meanwhile, the West Coast, which is presently down 4%, has improved from the prior month when it posted a 9% contraction.

Civil Spending Falters in Key Regions

Civil construction spending in 2025 has failed to act as the pillar of strength that it has been in recent years. Only in New England, up 43%, the East North Central, gaining 18%, and the West Coast, up 14%, is civil activity outpacing last year’s results.

Unfortunately, in much of the middle of the nation, this crucial activity is faltering. Spending is particularly weak in the Mountain division, down 20%, and slightly less so in both Atlantic divisions.

Stay Connected

Read the Construction Economy Snapshot for more details on construction labor, trends, and national analysis.

About ConstructConnect

At ConstructConnect, our software solutions provide the information that construction professionals need to start every project on a solid foundation. For more than 100 years, our keen insights and market intelligence have empowered commercial firms, building product manufacturers, trade contractors, and architects to make data-driven decisions, streamline preconstruction workflows, and maximize their productivity. Our newest offerings—including our comprehensive, AI-assisted software—help our clients find, bid on, and win more projects.

ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.

For more information, visit constructconnect.com